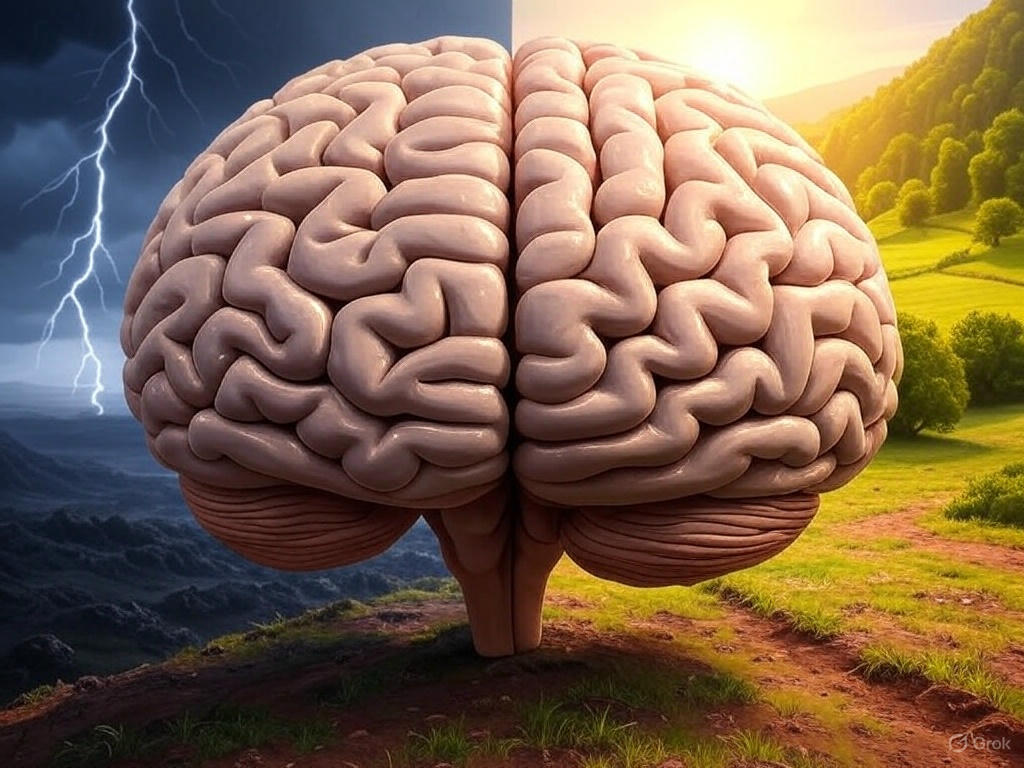

Your mindset was wired

2025 is a fist fight for the construction industry.

John, our 60-year-old plumber with a $4M firm, and Bob, our 42-year-old electrician with an $8M shop, battle 20% tariffs, 15% labor shortages, and 5 to 6% interest rates. Last post, we unveiled Extraction versus Builder Mindsets. John hoards cash for a quiet retirement. Bob bets big for a $10M exit. Neither is the better path: your goals and context call the shots.

Why does John pick Extraction? Loss aversion owns him. The 2008 crash crushed his peers. Those scars yell: “Don’t lose it all.” At 60, he protects family and a paid-off house, not chasing risks for fun.

Status quo bias keeps John anchored. He cuts costs and skips upgrades. It’s safe, forged in a Midwest upbringing where steady work was king. A high school grad, he banks on grit over books.

Your past isn’t just history: it’s your amygdala programmed through the years.

Bob’s Builder Mindset burns with opportunity bias, a thirst for what’s next. At 42, doubling his firm in a decade sparks overconfidence. A 2015 tech bust honed his bets, not halted them. He’s not reckless: he’s chasing legacy.

Bob’s Sun Belt roots, alive with growth, fuel expansion. His business degree and mentors arm him for 2030’s net-zero jobs. Young kids and a long runway, his life stage, demand building now.

Age and ambition split them. John’s near the end: every dollar’s a shield. Bob’s got decades: growth pulls him. Past experiences cement it. John’s recession nightmares breed caution. Bob’s early wins ignite hunger.

Your brain’s a quiet puppet master, tugging invisible strings.

Region shapes them. John’s Midwest conservatism grips the known. Bob’s bold South thrives on risk. Education tilts it. John’s street-smarts lock in stability. Bob’s training scans the future. Biases like anchoring, John stuck on old losses and Bob on future gains, and framing, John seeing risks as traps and Bob as hurdles, fix their paths.

Your mindset’s a stew of scars, stage, and surroundings.

John and Bob aren’t right or wrong: they’re wired to respond to threats. But what if your dreams don’t match your mindset? John craving a big exit while pinching pennies, or Bob playing it safe with empire-sized goals? Misalignment breeds stress, missed shots, and a business that stumbles.

Your choices must sync with your endgame, or you’re boxing your own shadow. Have you ever think about what that endgame looks for you?